DRIVING POSITIVE SOCIAL AND ENVIRONMENTAL IMPACT

Values help define you. Let your investments reflect those values.

Peace of mind comes from knowing that your investments are producing competitive returns and that you haven’t sacrificed social and environmental standards for that performance. Your investment advisor should help you focus on what matters to you.

Looking to do more with your money? If you’ve had difficulty finding that balance of purpose and performance for your investments, let’s talk about how you can align your financial future with your values.

PERSONALIZED ATTENTION

Our strategies and investment selections continually align to meet your personal goals.

EXCEPTIONAL EXPERTISE

Our expertise spans over 40 years, allowing us to provide exceptional investment management and advice.

EMPATHETIC SUPPORT

As a founder-CEO firm, we understand the importance of your perspective.

Our firm encourages a thought process which helps to incorporate your values and intent while preserving the environment and enhancing society.

Our investment management incorporates Sustainable / Responsible / Impact investing criteria to create long-term, sustainable portfolio performance to obtain competitive financial returns, while providing positive societal impact.

SUSTAINABLE INVESTING

Sustainable investing focuses on integrating Environmental, Social and Corporate Governance (ESG) analysis with the financial analysis in the investment selection process.

ENVIRONMENTAL CRITERIA

Considers natural conservation, energy usage, pollution, waste and treatment of animals. Environmental risks that might affect income are evaluated, along with how the risks are managed.

SOCIAL CRITERIA

Considers the management of relationships with businesses, employee working conditions, customer treatment and the support of surrounding communities.

GOVERNANCE CRITERIA

Considers the transparency and accuracy methods. Focuses on conflicts of interests regarding board members, leadership and top executives. Looks for shareholder rights, ability to vote on key issues and investments that avoid illegal behavior.

RESPONSIBLE INVESTING

Responsible Investing, or Socially Responsible Investing, focuses on avoiding investments that have conflict and seek investments that support an investor’s values. These values may consider an investor’s personal, political and/or religious preferences.

TOP SRI/ESG SCREENING CRITERIA FOR INVESTORS

- Climate Change / Carbon / Clean Technologies

- Environment

- Pollution / Toxics

- Community Development

- Diversity / Equal Opportunity

- Human Rights

- Conflict Risk (Terrorist or Repressive Regimes)

- Labor Relations

- Company Board Issues

- Executive Pay

- Shareholder Engagement

- Transparency and Anti-Corruption

- Alcohol

- Animal Welfare

- Defense / Weapons

- Gambling

- Tobacco

IMPACT INVESTING

Impact Investing focuses on investing that is beneficial for specific social and/or environmental effects in addition to financial gain. Community Investing and shareholder advocacy are classic examples of Impact Investing.

TOP IMPACT CRITERIA FOR INVESTORS

- Affordable Housing

- Nonprofit Healthcare

- Community Development

- Green Space Conservation

- Energy Efficiency

- Low Carbon

- Shareholder Proposals

- Proxy Voting

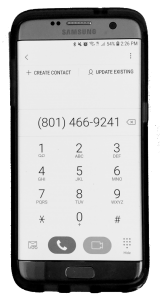

What's your next step?

Give us a call.

We help you incorporate sustainable, responsible and impact investing with your values and goals. We believe that individuals, families, small businesses and institutions can achieve more, while having a positive impact on society. We start with a simple conversation to help determine the extent or your values and goals in order to provide the appropriate investment plan and strategies.

Our Invest Right / Retire Right plan analysis targets three main support services for your investment plan:

- Effective Client Assessment

- Investment Strategy Formulation

- Custom Risk Profile Design

You’ll receive an in-depth report that evaluates your current investment portfolios and presents a proposed investment strategy which incorporates your risk profile and aligns with our proprietary Model Portfolio Strategies.

Contact us at 801-466-9241 to discover if our Invest Right / Retire Right plan analysis would benefit you.